Economic and market outlook for 2025: Global summary

.

Global inflation has slowed sharply in the last two years and is now within touching distance of 2%. But the path to disinflation has been uneven across countries, with most developed markets enduring monetary-policy-induced slowdowns to get there. The United States is a notable exception, having experienced accelerating economic growth and full employment with no discernible effect from restrictive monetary policy.

Has the U.S. achieved a soft landing? Or will the impact of high interest rates eventually lead to a hard landing? These questions have dominated the market narrative over the last two years, with the focus on whether the U.S. Federal Reserve (the Fed) can perfectly time the rate-cutting cycle to achieve painless disinflation.

Yet this emphasis on the “landing” may not fully explain the pairing of exceptionally strong growth and falling inflation that we’ve witnessed in the U.S. The forces that do explain it suggest a new narrative for the economy and markets.

In our 2025 outlook, we adopt a framework centred on the supply-side forces that have shaped the U.S. economy. These include a surge in both labour productivity and available labour. Supply-side forces offer a more satisfying explanation for the positive growth and inflation dynamic. Emerging risks—such as those related to immigration policies, geopolitics, or potential tariffs—also fit more naturally into this supply-side-aware framework.

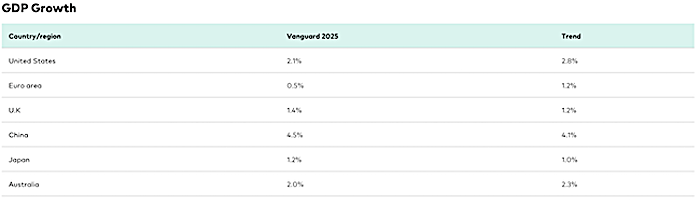

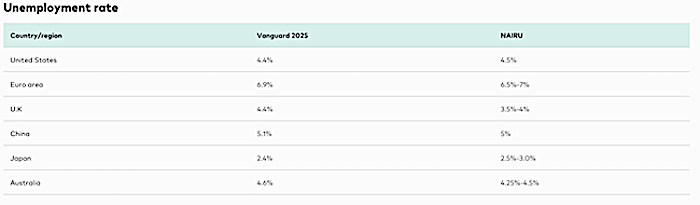

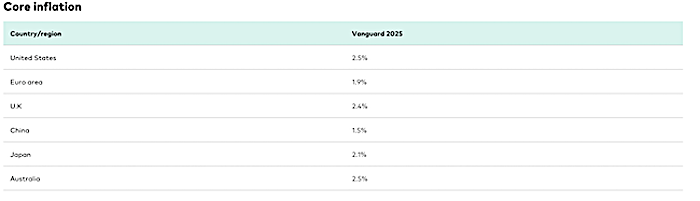

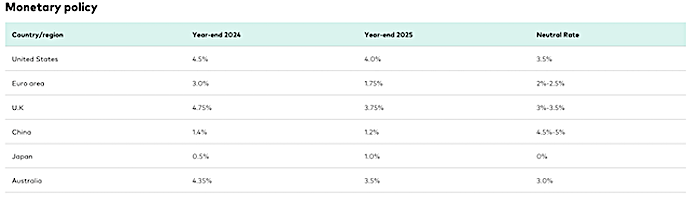

Vanguard's 2025 economic forecasts

Notes: Forecasts are as of 12 November 2024. For the U.S., GDP growth is defined as the year-over-year change in fourth-quarter GDP. For all other countries/regions, GDP growth is defined as the annual change in GDP in the forecast year compared with the previous year. Unemployment forecasts are the average for the fourth quarter of 2025. NAIRU is the nonaccelerating inflation rate of unemployment, a measure of labour market equilibrium. Core inflation excludes volatile food and energy prices. For the U.S., euro area, U.K., and Japan, core inflation is defined as the year-over-year change in the fourth quarter compared with the previous year. For China, core inflation is defined as the average annual change compared with the previous year. For the U.S., core inflation is based on the core Personal Consumption Expenditures Index. For all other countries/regions, core inflation is based on the core Consumer Price Index. For U.S. monetary policy, Vanguard’s forecast refers to the top end of the Federal Open Market Committee’s target range. China’s policy rate is the seven-day reverse repo rate. The neutral rate is the equilibrium policy rate at which no easing or tightening pressures are being placed on an economy or its financial markets. This table displays our median neutral rate estimates with an effective range of +/–0.5 percentage points.

U.S. economic resilience has little to do with Fed policy

Against the backdrop of restrictive monetary policy, the U.S. economy has had the favourable combination of strong real GDP growth, loosening of overly tight labour markets, and falling inflation. With headlines on Fed policy always front and centre, it is tempting to attribute this good fortune to a ”soft landing” engineered by the Fed. However, a closer look suggests that this interpretation may be insufficient.

Rather, continued U.S. robustness may owe more to the fortuitous supply-side factors, including higher productivity growth and a surge in available labour. Higher output and lower inflation can generally coexist only when the supply-side forces are in the driver’s seat. These dynamics have altered our baseline U.S. economic outlook and point to the primary risks on the horizon.

While the positive supply-side drivers of growth may continue in 2025, emerging policy risks such as the implementation of trade tariffs and stricter immigration policies may offset gains. Under such a scenario, U.S. real GDP growth would cool from its present rate of around 3% to closer to 2%. These offsetting policy risks may also increase inflationary pressures. Therefore, we anticipate that core inflation will remain above 2.5% for most of 2025. Although we expect the Fed to reduce its policy rate to 4%, cuts beyond that would prove difficult as any weakening growth would have to be weighed against a potential inflation revival.

Economies outside of the United States have been less lucky on the supply side, and thus unable to achieve the same combination of strong growth alongside significantly reduced inflation. While inflation is now close to target in Europe, that has come at the price of stagnation in 2023 and 2024, with muted external demand, weak productivity, and the lingering effects of the energy crisis holding activity back. Growth is expected to remain below trend next year, as a slowdown in global trade represents a key risk. Expect the European Central Bank to cut rates below neutral, to 1.75%, by the end of 2025.

In China, policymakers still have work to do despite their coordinated policy pivot in late 2024. Growth should pick up in the coming quarters as financing conditions ease and fiscal stimulus measures kick in. But more decisive and aggressive measures are needed to overcome intensifying external headwinds, structural issues in the property sector, and weak confidence in both the household and business sectors. We maintain our weaker-than-consensus secular view on Chinese growth, and thus expect additional monetary and fiscal loosening in 2025.

Era of sound money lives on, with a new point of tension emerging

Although central banks are now easing monetary policy, we maintain our view that policy rates will settle at higher levels than in the 2010s. This environment sets the foundation for solid cash and fixed income returns over the next decade, but the equity view is more cautious. This structural theme holds even in a scenario where central banks briefly cut rates below neutral to allay temporary growth wobbles. The era of sound money—characterised by positive real interest rates—lives on.

The investment challenge is a growing point of tension in risk assets between momentum and overvaluation. Assets with the strongest fundamentals have the most stretched relative valuations, and vice versa. The economic and policy risks for 2025 will help determine whether momentum or valuations dominate investment returns in the coming year.

Balance of risks favours bonds

Higher starting yields have greatly improved the risk-return trade-off in fixed income. Bonds are still back. Over the next decade, we expect 4.3%–5.3% annualised returns for both U.S. and global ex-U.S. currency-hedged bonds. This view reflects a gradual normalisation in policy rates and yield curves, though important near-term risks remain.

We believe that yields across the curve are likely to remain above 4% in the U.S. A scenario where supply-side tailwinds persist will be supportive for trend growth and thus real rates. Alternatively, the emerging risks related to global trade and immigration policies would also keep rates high due to increased inflation expectations. These risks must be balanced with the risk that a growth shock, and any associated monetary easing or “flight to safety”, would cause yields to fall meaningfully from current levels.

Higher starting yields, which imply a “coupon wall”, mean that future bond returns are less exposed to modest increases in yields. In fact, for investors with the time horizon to see coupon payments catch up, interest rates that rise further would improve their total returns despite some near-term pain. We continue to believe fixed income plays an important role as a ballast in long-term portfolios. The greatest downside risk to bonds also pertains to stocks—namely, a rise in long-term rates due to continued fiscal-deficit spending or removal of supply-side support. These are the dynamics we are most closely monitoring.

Rational or irrational exuberance: Only time will tell

U.S. equities have generally delivered strong returns in recent years. 2024 was no exception, with both earnings growth and price/earnings ratios exceeding expectations. The key question for investors is, “What happens next?”

In our view, U.S. valuations are elevated but not as stretched as traditional metrics imply. Despite higher interest rates, many large corporations insulated themselves from tighter monetary policy by locking in low financing costs ahead of time. And more importantly, the market has been increasingly concentrated toward growth-oriented sectors, such as technology, that support higher valuations.

Nevertheless, the likelihood that we are in the midst of a valuation-supporting productivity boom, akin to the mid-1990s, must be balanced with the possibility that the current environment may be more analogous to 1999. In the latter scenario, a negative economic development could expose the vulnerability of current stock market valuations.

While the median of the U.S. return outlook over the next decade at 2.9%-4.9% appears overly cautious – as does the outlook for global ex-AU equities at 4.3%-6.3% – the range of possible outcomes is wide, and valuations are rarely a good timing tool. Ultimately, high starting valuations will drag long-term returns down. But history shows that, absent an economic or earnings growth shock, U.S. equity market returns can continue to defy their valuation gravity in the near term.

Valuations of non-US equity markets are more attractive. We suspect this could continue as these economies are likely to be most exposed to rising global economic and policy risks. Differences in long-term price/earnings ratios are the biggest driver of relative returns over five-plus years. Over the next decade, we expect Australian equities, developed markets ex-US equities and emerging market equities to return 4.4%-6.4%, 7.4%-9.4% and 5.4%-7.4%, respectively. However, economic growth and profits matter more over shorter horizons. Over the past few years, persistently lackluster growth in the economies and earnings outside the U.S. kept global ex-US equity returns lukewarm relative to the remarkable return in the U.S. market. Within emerging markets, China is the sole reason valuations are below fair value, but the risks of rising trade tensions and insufficient fiscal stimulus in China pose additional headwinds.

The strong outlook for fixed income together with a more cautious long-term view for U.S. equities means that – for investors with an appropriate risk profile – more defensive portfolios may be appropriate, given that the extra compensation for taking on more risk remains low relative to history. We expect a 60/40 portfolio to return 4.9%-6.9% over the next decade

IMPORTANT: The projections and other information generated by the VCMM regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Distribution of return outcomes from VCMM are derived from 10,000 simulations for each modeled asset class. Simulations as of November 8, 2024. Results from the model may vary with each use and over time. For more information, please see the Notes section.

Notes:

All investing is subject to risk, including the possible loss of the money you invest. Be aware that fluctuations in the financial markets and other factors may cause declines in the value of your account. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. Diversification does not ensure a profit or protect against a loss.

Investments in bonds are subject to interest rate, credit, and inflation risk.

Investments in stocks and bonds issued by non-U.S. companies are subject to risks including country/regional risk and currency risk. These risks are especially high in emerging markets.

IMPORTANT: The projections and other information generated by the Vanguard Capital Markets Model regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. VCMM results will vary with each use and over time.

The VCMM projections are based on a statistical analysis of historical data. Future returns may behave differently from the historical patterns captured in the VCMM. More important, the VCMM may be underestimating extreme negative scenarios unobserved in the historical period on which the model estimation is based.

The Vanguard Capital Markets Model® is a proprietary financial simulation tool developed and maintained by Vanguard’s primary investment research and advice teams. The model forecasts distributions of future returns for a wide array of broad asset classes. Those asset classes include U.S. and international equity markets, several maturities of the U.S. Treasury and corporate fixed income markets, international fixed income markets, U.S. money markets, commodities, and certain alternative investment strategies. The theoretical and empirical foundation for the Vanguard Capital Markets Model is that the returns of various asset classes reflect the compensation investors require for bearing different types of systematic risk (beta). At the core of the model are estimates of the dynamic statistical relationship between risk factors and asset returns, obtained from statistical analysis based on available monthly financial and economic data from as early as 1960. Using a system of estimated equations, the model then applies a Monte Carlo simulation method to project the estimated interrelationships among risk factors and asset classes as well as uncertainty and randomness over time. The model generates a large set of simulated outcomes for each asset class over several time horizons. Forecasts are obtained by computing measures of central tendency in these simulations. Results produced by the tool will vary with each use and over time.

vanguard

27 Nov 2024

vanguard.com.au